The bank made for travel

Pay anywhere and in any currency on your debit or credit card. Split bills in just a few taps, and upgrade to Monzo Max for worldwide travel insurance.

UK residents only. Ts&cs apply.

Your bank account for going abroad

Free yourself from fees

Pay anywhere and in any currency – on your debit or credit card – with no foreign transaction fees or hidden costs. That leaves more money for souvenir T-shirts.

Make free cash withdrawals abroad

If Monzo's your main bank account, make unlimited fee-free withdrawals in the European Economic Area (EEA), and up to £200 every 30 days anywhere else. After that, we'll charge 3%.

See exchange rates in the app

Understand exactly what you're spending by seeing the real-time exchange rates when you spend abroad.

Stay in the know, wherever you go

Keep track of travel costs with instant notifications every time you spend. We'll also send you a detailed spending report at the end of your trip.

Split bills in a tap

Put the calculator down and split bills in the app – whether your friends are on Monzo or not. You just have to remember who had dessert.

Settle up in seconds

Track how much everyone owes and settle up whenever you like with a Shared Tab. You focus on the good times, we'll do the maths.

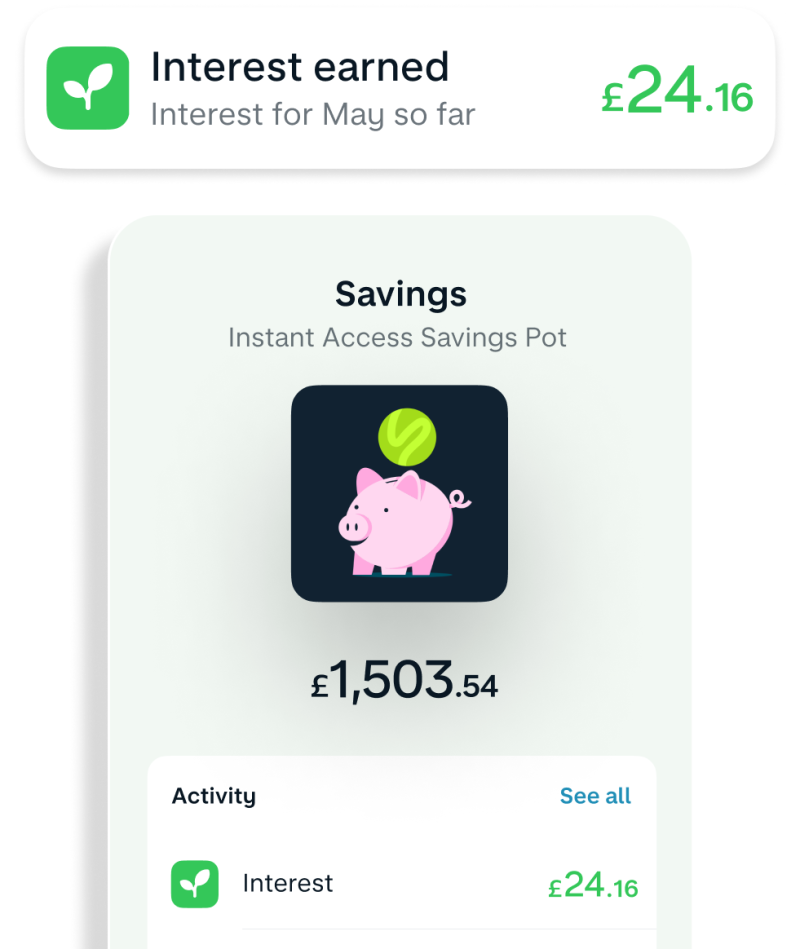

Watch your spending money grow

Earn 4.10% AER (variable) on your travel funds with an Instant Access Savings Pot.

And you can lock or hide it so you're not tempted to spend your tapas money on takeaways.

A credit card with travel perks

0% interest…

when paying in full on your next payment date or in 3 monthly payments. If you want more time, it's 29% APR representative (variable) for up to 24 monthly payments.

Fee free spending…

at home or abroad, in any currency. And we don't add a mark-up on Mastercard's exchange rate.

Book with confidence...

by paying for your trip with the Flex Credit Card. If something goes wrong, you could be able to get your money back on eligible purchases with Section 75 Purchase Protection.

Travel abroad often? Upgrade to Monzo Max

Frequently asked questions

Are there any fees associated with using Monzo abroad?

You can pay anywhere in any currency using your Monzo card, fee-free. We pass Mastercard’s exchange rate directly onto you, without sneaky fees or extra charges. You can also make free cash withdrawals up to a certain limit (see below).

What is the European Economic Area?

The European Economic Area (EEA) includes EU countries and also Iceland, Liechtenstein and Norway.

How do I know if Monzo is my main bank?

If you have a free account and meet any of the below criteria, then we consider Monzo to be your main bank:

At least £500 was paid into a Monzo account in your name over the last rolling 35-day period, and you have at least one active Direct Debit on the same account in the same period.

You’ve received a Department for Work and Pensions or a Department for Communities payment into a Monzo account in your name over the last rolling 35-day period.

You’ve received a student loan payment into a Monzo account in your name over the last rolling 8-month period.

You’re sharing a Monzo Joint Account with someone who has done at least one of the above.

Remember that if you use Monzo as your main bank, you can enjoy unlimited fee-free cash withdrawals in the European Economic Area (EEA).

Do I need to let Monzo know when I’m travelling abroad?

If your Monzo card is lost or stolen while travelling, immediately freeze your card and contact our customer support team for assistance (you can do both through the Monzo app).

What is the Monzo cash withdrawal limit when using my card abroad?

Depending on how you use Monzo, you can make fee-free cash withdrawals up to a certain limit. Any fees you may have to pay are partly based on whether you’re in the European Economic Area (EEA) or not. The EEA includes EU countries and also Iceland, Liechtenstein and Norway.

If Monzo is your main bank account,make unlimited fee-free cash withdrawals abroad in the European Economic Area (EEA),and up to £200 every 30 days for free outside the EEA. After that, we’ll charge 3%.

The 30-day period for allowances resets exactly 30 days after your first withdrawal, rather than at the start of a new month. Your allowances are shared across any accounts you have. So if you have a joint account, your allowance is split across that account and your personal account. For example, if you take out £150 on the 2nd of the month and £50 on the 5th, your allowance would reset on the 2nd and 5th day of the next month. If you made a third withdrawal before those dates, then we'd charge the withdrawal fee.

Just be aware that some ATMs will charge you a fee for taking out cash (which we don’t receive), so we recommend using a free machine whenever you can.

What should I do if my Monzo card is lost or stolen while I am travelling?

If your Monzo card is lost or stolen while travelling, immediately freeze your card and contact our customer support team for assistance (you can do both through the Monzo app).