A free current account that fits your finances

Organise your life with Pots. Earn 4.10% AER (variable) on instant access savings. Spending insights you’ll actually use. All wrapped in one cool, hot coral package.

UK residents only. Ts&Cs apply.

Bank on an award-winning app

Instant spending notifications

Switch on instant spending notifications so you’re never out of the loop.

See your money in a whole new light

Get to know your spending habits with weekly and monthly insights. Get alerts if you’re spending too fast (if you want them).

Earn 4.10% AER (variable)

Paid monthly with an Instant Access Savings Pot or Instant Access Cash ISA. Deposit up to £100,000 with no minimum deposit, and withdraw it whenever you need to.

Save as you spend

Every time you spend money, we’ll round it up to the nearest pound and put the spare change in a Pot for you. All you need to do is switch on roundups. People on Monzo save on average £100 extra each year this way.

Spend with friends

Split bills, send payment reminders, and stay on top of joint costs, even if someone’s not on Monzo.

Refreshingly simple cashback

Cashback doesn’t have to be hard. Pick your offers, shop in person or online and see what you’ve earned instantly. Simple.

Add or move money the Monzo way

Deposit cash or cheques

Wave goodbye to lengthy branch visits. Pay in cheques up to £500 in the app. Deposit cash in any Post Office or PayPoint.

International transfers in partnership with Wise

Transfer money to your friends and family within the Monzo app through Wise.

It’s typically lower cost than Western Bank, MoneyGram and Zoom, as well as high street banks.

Help whenever you need it

Speak to us whenever you need, wherever you are. Our team’s there to help you through in-app chat or on the phone, 24/7.

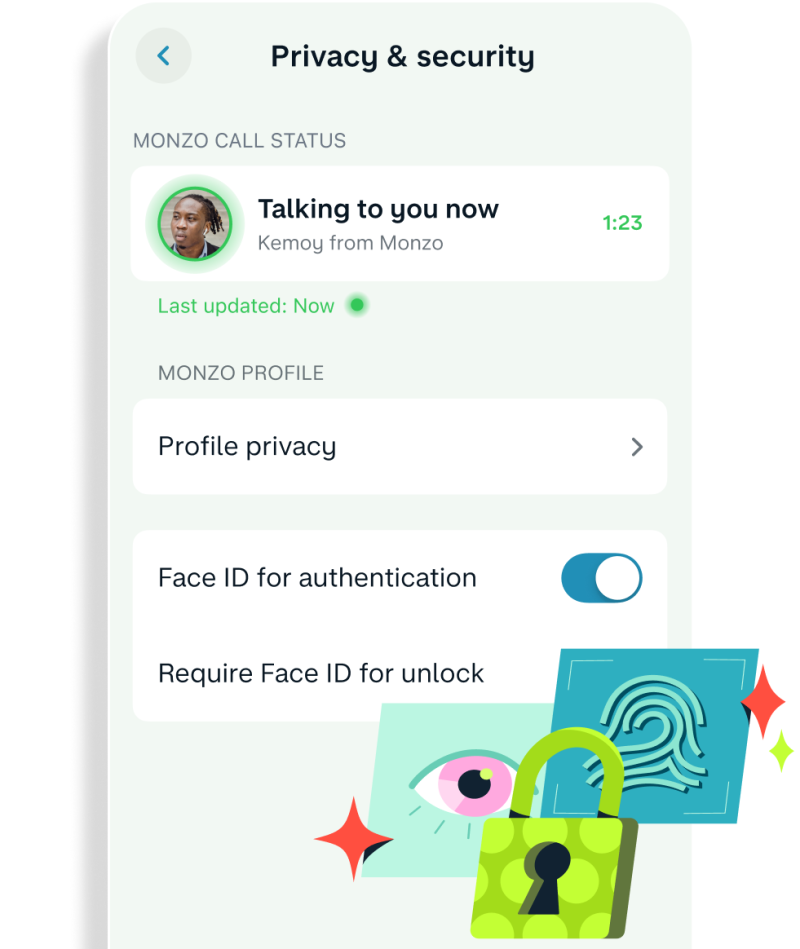

We care about security

Now more than ever, threats to your money come from online scams and phone fraud. We use industry-leading tech, like a tool that tells you whether or not you're speaking to a scammer in real time, to keep you safe.

We’re also a fully regulated UK bank, which means your money is protected by the FSCS up to £85,000.

Upgrade your UK current account

We're making money work for everyone, so we have different plans for different needs.

Free

Extra

Perks

Max

Free

months minimum

Free

Free

months minimum

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Extra

£3 a month

months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes everything from Free, plus:

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

Aged 18+ • Ts&Cs apply

Perks

£7 a month

months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

Includes everything from Free, Extra, plus:

4.60% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

Aged 18+ • Ts&Cs apply

Max

From £17 a month

3 months minimum

Includes all features from Free

A UK current account

Your eligible deposits are protected by the FSCS up to £85,000 per person

All the Monzo features you know and love

4.10% AER (variable) interest, paid monthly

Includes all features from Extra

Connected banks and credit cards

Virtual cards

Advanced roundups

Custom categories

Auto-spreadsheet

Credit insights

Fee-free withdrawals up to £200

Includes all features from Perks

4.60% AER (variable) interest, paid monthly

Fee-free withdrawals up to £600

3 fee-free cash deposits

Discounted investment fees

Annual Railcard

Weekly Greggs treat

Includes everything from Free, Extra, Perks, plus:

Personal worldwide travel insurance – provided by Zurich, powered by Qover

Personal worldwide phone insurance – provided by Assurant

Personal UK & Europe breakdown cover - provided by RAC

Add your family to your insurance and cover for an extra £5 a month

Aged 18-69 • Ts&Cs apply

Easy current account switching

With the Current Account Switch Service, you can move everything over to Monzo in 7 days without lifting a finger. We do everything for you, and you don’t need to deal with your old bank at all.